The insurance industry is characterized by highly complex workflows that involve multiple stakeholders, strict regulatory compliance, and massive volumes of documents. Inefficient document workflows can lead to delays, compliance risks, and dissatisfied customers. Efficient document management is critical to maintaining control, ensuring compliance, and delivering seamless customer service. The good news is that AI in insurance document management and RPA services are revolutionizing insurance document management.

By streamlining processes, reducing manual effort, and enhancing accuracy, workflow automation powered by AI is enabling insurers to transform operations and deliver the superior service customers demand. In 2025, 91% of insurance companies are adopting AI technologies, with the global AI-in-insurance market valued at $3.9 billion, and projected to reach $6.92 billion by 2028 (CoinLaw). Additional projections from Zipdo estimate the AI-in-insurance market will hit $14.3 billion by 2025, growing at a CAGR of 24.4%, and potentially reaching $28 billion by 2027.

The Growing Need for Smarter Insurance Document Management

From policy applications and contracts to customer proofs, policyholder agreements, and claim forms, insurers manage an enormous volume of documents daily—often amounting to millions of files each year. Traditional manual, document-heavy workflows slow down operations and undermine policy management efficiency, leading to risks that can compromise both performance and client trust.

Fragmented legacy systems, complex compliance requirements, inconsistent data formats, and stringent regulatory checks all add to the complexity of insurance document management and slow down decision-making, according to Forbes. As a result, “workflows more closely resemble a complex maze than a straightforward, predictable sequence”.

To overcome these challenges, intelligent document processing (IDP) and modern document management solutions have become essential. They help insurers tackle the following critical issues:

- Error-prone, labor-intensive processes: Manual tasks like data entry, approvals, and physical document storage are time-consuming and labor-intensive, increasing operational costs. Manual processes are also prone to typos, misinterpretations, and data entry mistakes, leading to costly errors.

- Scalability issues: Manual workflows struggle to keep up with the large and growing volumes of documents,

- Compliance challenges: keeping up with evolving regulations is difficult, increasing the risk of non-compliance with various industry standards

- Complexity of data extraction: Insurance documents are often unstructured and complex, making accurate data extraction a challenge

- Diminished customer experiences: Long wait times, fragmented processes, and a confusing onboarding experience due to manual systems frustrate customers and agents.

AI has emerged as a transformative solution by automating document-intensive workflows, enhancing accuracy, and enabling insurers to deliver faster, more efficient, and customer-centric services.

Role of AI in Transforming Insurance Document Workflows

Fragmented legacy systems, complex compliance requirements, inconsistent data formats, and stringent regulatory checks all add to the complexity of insurance document management and slow down decision-making.

AI-powered automation for insurance documents addresses these challenges:

Document Digitization and Classification

AI automatically converts paper or unstructured files into digital formats and then sorts and categorizes them, making retrieval faster and reducing manual effort. For example, insurers receive thousands of scanned policy applications every month. AI automatically converts them into searchable digital files, tags them by policy type (auto, health, life), and routes them to the right department without manual sorting.

Data Extraction and Validation

With AI-powered systems, staff no longer need to manually enter information from claim forms. Natural Language Processing (NLP) and Machine Learning (ML) in insurance automatically read through claims and policies to identify and extract key details such as names, policy numbers, coverage terms, and claim amounts, and then validate these against the insurer’s database for accuracy. This ensures faster and more accurate processing.

Customer Service and Personalization

AI not only enhances customer-facing interactions but also ties directly into document management workflows. For example, when AI chatbots answer policy questions or guide customers through quotes, they automatically capture and categorize the documents generated during the interaction, ensuring they are stored and routed correctly. Similarly, recommendation engines that suggest personalized coverage can activate updates in policy documents, with AI handling the modification, classification, and compliance checks. In life insurance, when AI detects a change in a customer’s marital or employment status, it can automatically initiate the required document updates, validate supporting proofs, and ensure the revised policy is compliant—streamlining the end-to-end workflow without manual intervention.

Automated Compliance Checks

Insurers must comply with regional laws (e.g., GDPR, HIPAA, Solvency II). Regulatory audits require thorough documentation and tracking. AI can monitor transactions and communications for compliance violation, ensuring documents meet regulatory requirements. It helps generate audit trails, automate reporting, and enforce rules. For example, to ensure HIPAA in health insurance claims, AI automatically reviews claim documents to ensure all mandatory regulatory fields are completed, flagging missing or non-compliant data before submission.

Fraud detection

Insurance fraud is a major issue, costing billions annually. Detecting fraud requires analyzing patterns across historical claims. AI flags suspicious documents or inconsistencies. For example, when a claim is submitted for the same vehicle damage multiple times, AI cross-checks historical claim records and flags the suspicious duplication for human review.

Claims Processing Automation

Improving claims processing with AI document management enables insurers to accelerate approvals, minimize errors, and deliver faster, more reliable service to policyholders. AI speeds up approvals and reduces human error. Optical character recognition (OCR) and NLP can automatically read and interpret scanned documents, PDFs, and emails. IDP tools extract data to feed into downstream systems. A claims form submitted via email can be automatically read, categorized, and entered into the claims system without human intervention. For example, AI processes a straightforward travel insurance claim for lost baggage end-to-end by verifying receipts, validating policy coverage, and approving payment, all within hours instead of weeks.

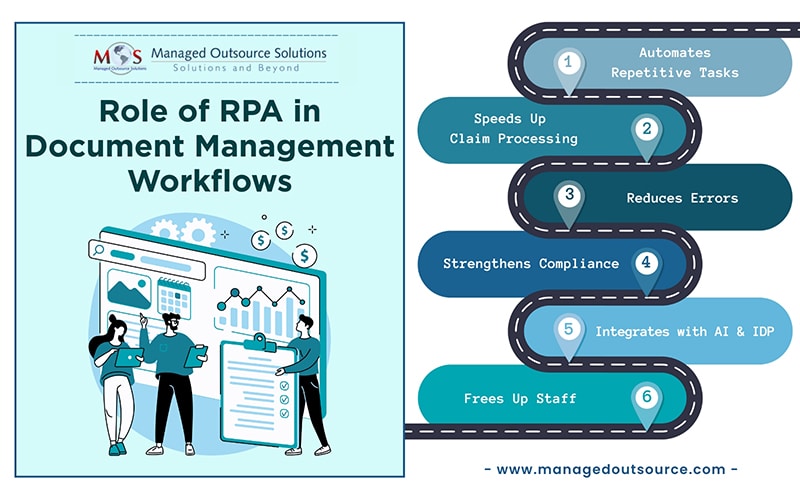

The Role of RPA in Document Management Workflows

Robotic Process Automation (RPA) streamlines insurance document management by handling repetitive, rule-based tasks. RPA bots capture data from emails, digitize and validate documents, and route them to the right department, reducing errors and speeding up workflows. For instance, RPA can process claim submissions by extracting details, verifying them against policy records, and initiating approvals within minutes. It also supports compliance by flagging incomplete or non-standard documents. When combined with AI and Intelligent Document Processing (IDP), RPA enables faster processing, higher accuracy, and smoother workflows—allowing staff to focus on customer service and strategic tasks.

Turning Document Challenges into Competitive Advantage

With rising customer expectations and strict regulatory demands, efficient document management is now a business-critical priority. AI-driven solutions, supported by workflow automation and RPA services, streamline claims, policies, compliance checks, and fraud detection. By partnering with a business process outsourcing company offering these smart tools, insurers can reduce errors, speed up processing, and focus teams on higher-value tasks. Those who embrace AI in insurance document management today will gain a competitive edge through improved customer experiences, stronger compliance, and sustainable growth.

Transform document management into a competitive advantage!

Explore our insurance automation solutions.