by Julie Clements | Last updated on Jun 6, 2025 | Published on Aug 18, 2017 | Data Processing Services, Outsourcing Services

Healthcare data security is constantly at risk of being compromised. Medical data breaches significantly impact individuals by exposing their personal, medical, and financial information, potentially leading to identity theft, financial losses, and psychological...

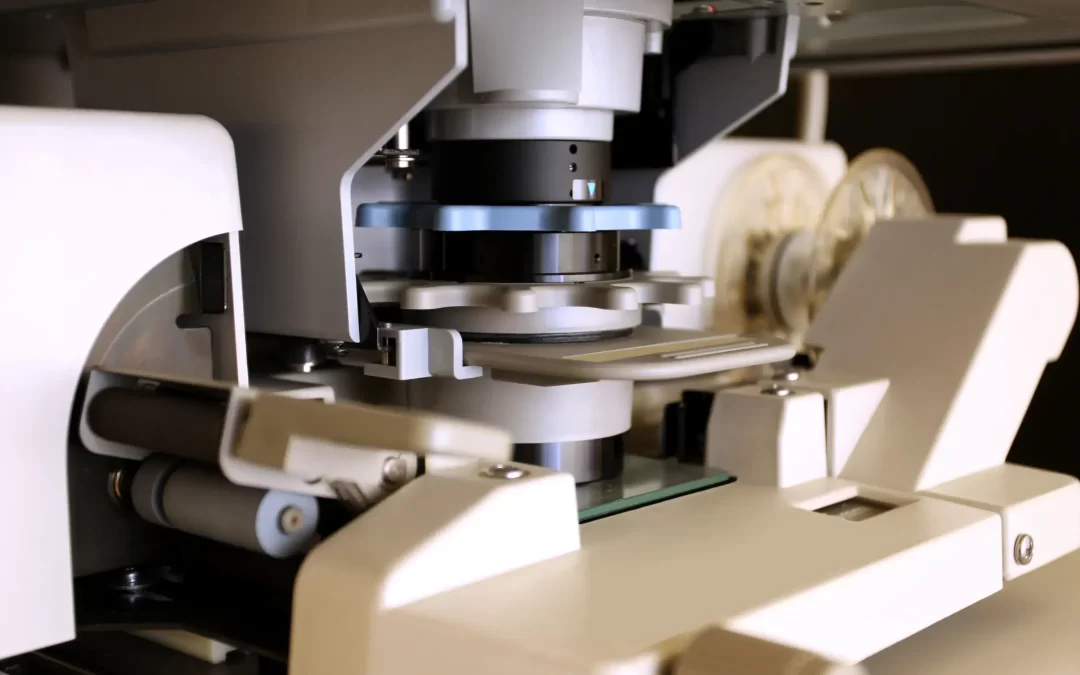

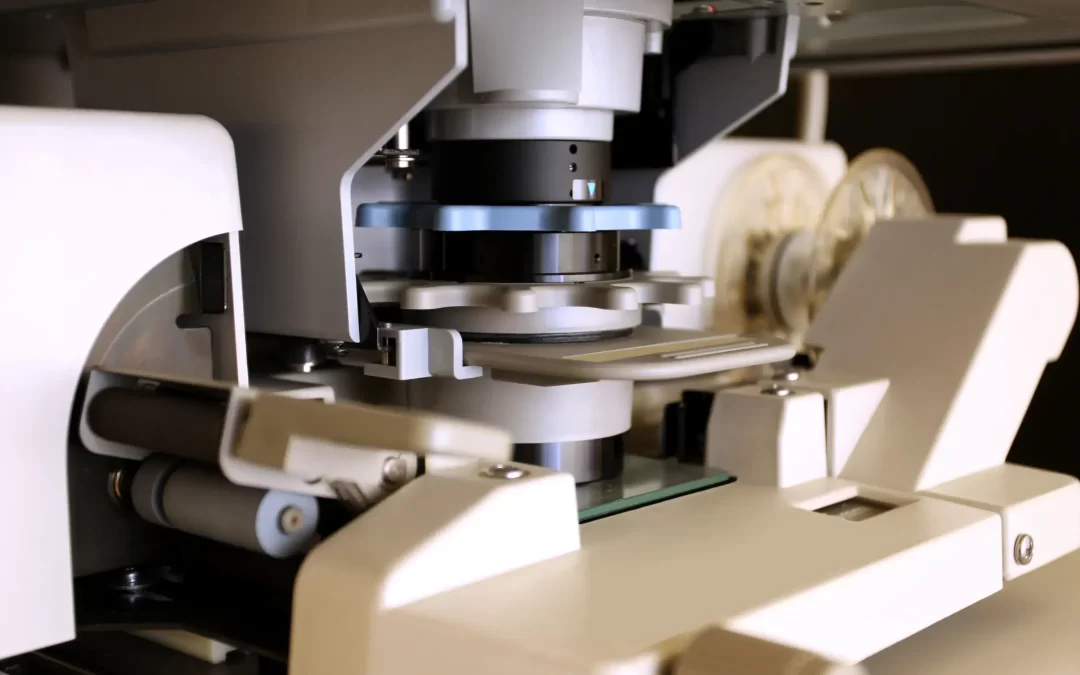

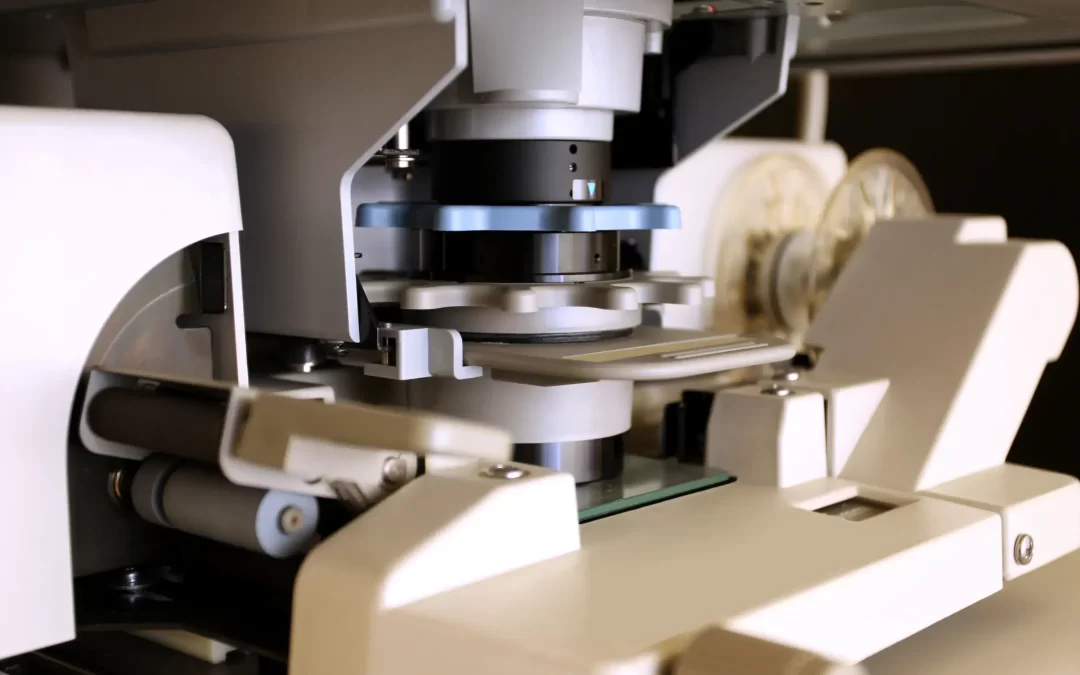

by Julie Clements | Last updated on Dec 5, 2024 | Published on Aug 14, 2017 | Document Conversion / Scanning Services

Many businesses, organizations, libraries, and research institutions possess extensive catalogues of microfiche documents, housing vital and sensitive data. Despite storing vast data, microfilm and microfiche pose challenges due to space requirements and vulnerability...

by Julie Clements | Published on Aug 4, 2017 | Document Conversion / Scanning Services

As part of digitization, banks and other financial institutions are getting digitized with the help of document conversion services. This is with a view to improve speed of transactions and overall efficiency and also to achieve a competitive edge. However, banks are...

by Julie Clements | Published on Jul 31, 2017 | Infographics

Often taxpayers have to keep their paper tax records for three years or more following the date of filing or the due date of their tax return. Those necessary tax records and other financial documents kept in boxes in a storage room somewhere, is of course difficult...

by Julie Clements | Published on Jul 25, 2017 | Legal Process Outsourcing

Whether your business is startup or a full-fledged one, maintaining certain legal documents is crucial to protect your startup from a legal perspective. Having a strong structure and well-drafted legal documents in place will protect your startup from launch, through...