Over the past few years, the banking and financial industry is facing several unique challenges and operational inefficiencies. They are under constant pressure to comply with rigorous regulatory requirements while delivering a seamless customer experience. Know Your Customer (KYC) is one of the most critical yet resource-intensive compliance processes which involves verifying customer identities to prevent fraud, money laundering, and other financial crimes. As customer bases grow and regulations become more stringent, banks are increasingly turning to Robotic Process Automation (RPA) to streamline and automate the KYC process. Regarded as a part of a broader digital transformation in banking, RPA in KYC automation aims to improve operational efficiency, reduce errors, enhance compliance accuracy and streamline and optimize various banking operations. This post explores in detail how banks are implementing RPA in their KYC processes, the benefits it brings, and what the future holds for automated compliance in the financial sector.

What Is RPA in Banking?

According to reports, RPA in the banking sector is expected to reach $1.12 billion by 2025. RPA in the banking industry can be leveraged to automate multiple time-consuming, repetitive processes like account opening, KYC process, customer services, and many others. It not only streamlines the process efficiency but also enables banking organizations to make sure that cost is reduced and the process is executed at an efficient time. In addition, by leveraging AI technology in conjunction with RPA, the banking industry can implement automation in complex decision-making processes like fraud detection, and anti-money laundering.

Understanding the Challenges in Traditional KYC

Before diving into automation, it’s important to understand the complexities of traditional KYC processes:

- Manual Data Collection and Entry: Customer data is often sourced from multiple documents and platforms, requiring human agents to manually input and verify information.

- Time-consuming Processes: Onboarding a new customer can take several days or even weeks, causing delays and poor customer satisfaction.

- High Operational Costs: Hiring and training compliance staff, along with managing manual workflows, leads to substantial financial overhead.

- Error-prone Tasks: Manual handling increases the risk of inaccuracies, leading to compliance breaches and penalties.

These challenges necessitate a more scalable and efficient solution – one that workflow automation and RPA are well-equipped to deliver.

Importance of RPA in Banking

In simple terms, RPA in KYC automation involves the use of software bots to perform rule-based tasks that were traditionally handled by human employees. These tasks include data extraction, document verification, identity checks, database cross-referencing, and report generation. Unlike traditional automation that might require complex system integration.

Robotic Process Automation works at the user interface level, allowing bots to mimic human interactions with existing applications. This makes it easier to deploy in legacy banking systems.

When it comes to banking operations, bank employees often tend to handle a huge amount of customer data and manual processes are inherently prone to errors. The extensive data extraction and manual processing involved in banking operations can lead to significant inaccuracies, which can have serious consequences. For instance, a single error in a critical banking process may result in cases of theft, fraud, or money laundering. Instead of relying on humans to process data manually, RPA can streamline these operations.

For instance, validating customer information from two different systems can take seconds with bots, as opposed to minutes when done manually. This efficiency not only reduces the likelihood of errors but also accelerates the overall process. Introducing bots for such manual tasks can lead to processing cost reductions (up to 30-70 percent). Moreover, by automating several processes within banks, employees can be freed up to focus on more critical and strategic tasks that require human intervention and decision-making.

How Banks Use RPA to Improve KYC Accuracy

Accuracy in KYC is a key aspect, as even small errors can lead to serious compliance issues. Here is how banks use RPA to improve KYC accuracy:

- Customer Service: Banks deal with multiple queries every day ranging from account information to application status to balance information. RPA can automate such rule-based processes to respond to queries in real time and reduce turnaround time to seconds, freeing up human resources for more critical tasks. With the help of artificial intelligence, RPA can also resolve queries that need decision-making. By using NLP, Chatbot automation enables bots to understand the natural language of chatting with customers and respond like humans.

- Fraud Detection: With the introduction of digital systems, one of the major concerns of banks is fraud. Banks find it difficult to track all the transactions to flag the possible fraud transaction. RPA can track the transactions and raise the flag for possible fraud patterns in real time, reducing the delay in response. In certain cases, RPA can prevent fraud by blocking accounts and stopping transactions.

- Compliance: Banking being the center of the economy is closely governed and needs to adhere to many compliances. RPA increases productivity with 24/7 availability and the highest accuracy, improving the quality of the compliance process.

- Accounts Payable: Regarded as a monotonous process in the banking system, Accounts Payable involves extracting vendor information, validating it, and then processing the payment. RPA with the help of optical character recognition (OCR) solutions can free you from monotony. OCR can read the vendor information from the digital copy physical form and provide information to the RPA system. RPA will validate the information with the information in the system and process the payment. If any error occurs, RPA can notify the executive for resolution.

- Credit Card Processing: Traditionally, credit card application processing used to take weeks to validate the customer information. The long waiting period made customers unhappy and increased costs. However, with the help of RPA, banks can now process the application within hours. RPA can communicate to multiple systems simultaneously to validate the information like required documents, background checks, credit checks and take the decision based on rules.

- KYC Process: Know Your Customer (KYC) is a mandatory process for banks for every customer. This process includes FTEs to perform necessary checks on the customers. According to Thomson Reuters, banks spend more than $384 million per year on KYC process compliance. Considering the cost of the manual process, banks have started using RPA to validate customer data. With increased accuracy, banks no longer have to worry about the FTEs and the process can be completed with minimal errors and staff.

- Mortgage Loan: The process of approving a mortgage loan goes through various checks like credit checks, repayment history, employment verification, and inspection. A minor error can slow down the process. As the process is based on a specific set of rules and checks, RPA can help reduce the processing time to minutes from days.

- Risk Assessment: RPA bots can be used to automate the risk assessment process. Machine learning algorithms can analyze customer behavior and identify any suspicious activity. The software robot can monitor transactions, flag any suspicious activity, and escalate issues to a human operator for further investigation.

- Document Review: Bots can be used to automate the review of documents such as financial statements or tax returns, to ensure compliance with regulatory requirements. The software robot can read and extract data from these documents, validate the data against databases or third-party sources, and flag any discrepancies for review.

- Compiling Customer Information: To get a complete overview of customer data, banks have to gather information from various sources, such as savings accounts, brokerages, etc. With the help of RPA bots, banks can automate the process of gathering, analyzing, and consolidating data from multiple systems to create a comprehensive view of customer information.

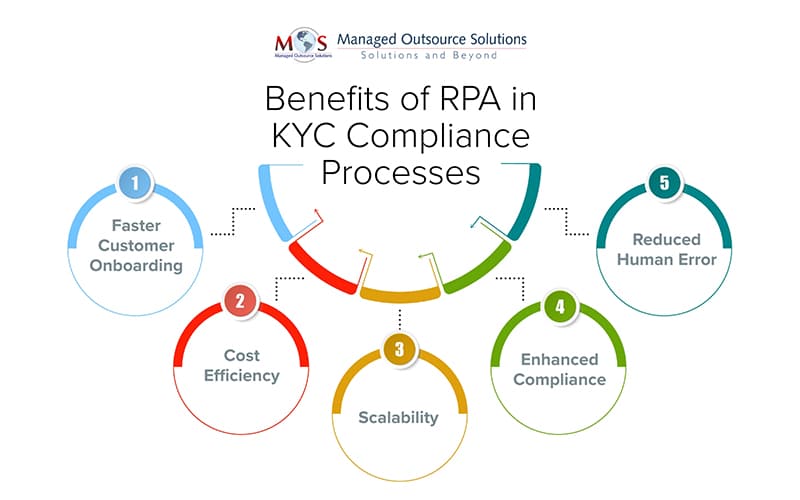

Benefits of RPA in KYC Compliance Processes

The benefits of RPA in KYC compliance processes are extensive and go beyond just cost savings:

- Faster Customer Onboarding: Automated KYC reduces friction during customer onboarding, leading to improved user experience and retention.

- Cost Efficiency: With automation, banks can reallocate staff to higher-value activities and significantly cut operational costs.

- Scalability: RPA allows banks to handle large volumes of KYC verifications during peak periods without the need to hire additional staff.

- Enhanced Compliance: With integrated compliance automation tools, banks can respond to regulatory changes more quickly and ensure ongoing adherence to KYC and AML (Anti-Money Laundering) laws.

- Reduced Human Error: RPA bots operate with near-perfect accuracy, minimizing the likelihood of data mismatches, missed red flags, or incorrect documentation.

In an era of stringent regulations and rising customer expectations, banks can no longer afford the inefficiencies of manual KYC processes. RPA in KYC automation is proving to be a game-changer — delivering faster processing times, improved accuracy, and enhanced compliance at a lower cost. By investing in workflow automation, adopting compliance automation tools, and driving digital transformation in banking, financial institutions can stay ahead of regulatory requirements while offering a seamless experience to their customers. As the financial landscape continues to evolve, RPA is not just a temporary fix but a long-term strategic asset in the bank’s digital transformation journey.

Looking to Streamline KYC with RPA Automation?