The persistent and competitive demands of the financial services industry has made it imperative for this sector to find the best technology solutions. The banking and financial industry is constantly striving to optimize costs and boost productivity. This calls for a fast track approach enabling systematic compliance management and operations. The integration of Artificial Intelligence (AI) and Robotic Process Automation (RPA) in financial institutions can streamline operations, improve customer experience, and ensure compliance – all while reducing costs. In this post, we will explore AI and RPA use cases in finance, highlight top AI‑driven banking solutions, and explain the benefits of intelligent automation for banks.

Need for Integrating RPA and AI

Robotic Process Automation and AI have taken banking and financial services to a whole new level by reducing manual labor for better compliance and mitigating risk factors. These two technologies help in organization and integration of workflow, follow previous patterns and decrease processing time of regular infrastructure security solutions. Right from customer onboarding, prompt processing of loans and deposits, security clearance to closure of customer accounts, these technologies have streamlined the entire chain of banking and financial processes. In the near future, the banking industry is expected to be hugely impacted by the automation wave, with 20-25% of all the tasks to be performed by machines and software bots.

Benefits of Intelligent Automation for Banks

- Operational Efficiency: Bots work 24/7 with no downtime, processing back-office tasks faster than human staff. By automating time-consuming tasks, RPA frees up employees to focus on higher-value, customer-centric activities, thus improving overall productivity.

- Improved Accuracy: RPA bots operate with precision, reducing the risk of human error, which is especially beneficial in high-stakes areas like transaction processing and compliance.

- Enhanced Customer Experiences: Instant responses via chatbots, less waiting in branches or calls, and personalized services improve brand trust and loyalty.

- Scalability and Flexibility: New bots and AI models can be deployed swiftly to address emerging needs – regulatory changes, new product lines, or unplanned spikes in demand.

- Regulatory Compliance: Audit trails, accurate reporting, and systematic checks help avoid fines and reputational damage. RPA can help banks remain compliant with regulatory standards by maintaining consistent, accurate records and generating automated compliance reports.

- Innovation & Competitive Edge: Banks that deploy AI and RPA use cases in finance gain significant advantages – offering innovative services ahead of the competition.

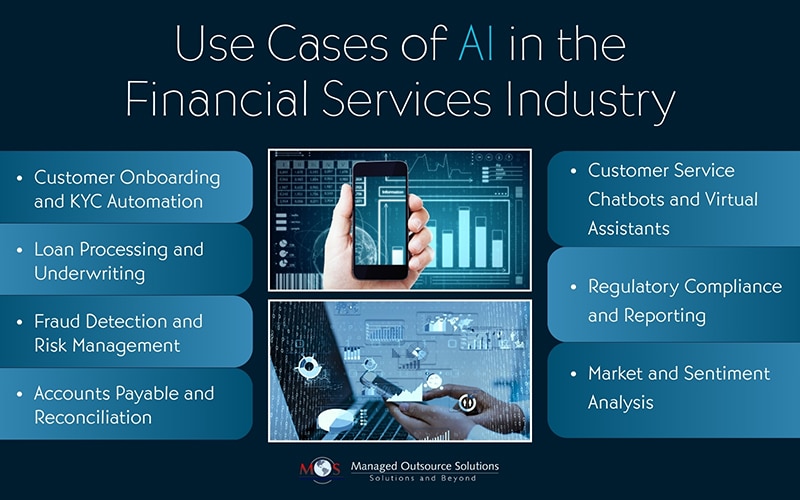

Use Cases of AI in the Financial Services Industry

The use cases of AI in the financial services industry are rapidly expanding, revolutionizing everything from fraud detection and customer service to risk management and investment strategies. As financial institutions embrace digital transformation, AI is playing a key role in driving efficiency, accuracy, and smarter decision-making.

- Customer Onboarding and KYC Automation – Know Your Customer (KYC) is a critical but labor-intensive compliance process. RPA bots can collect data from multiple sources – government databases, ID documents, address proofs – while AI algorithms verify authenticity, flag anomalies, and score risk profiles. Some of the key benefits include – reduced onboarding time from days to minutes, improved accuracy and compliance and enhanced customer experience. This is one of the most effective use cases of AI in the financial services industry, as it blends both speed and regulatory precision.

- Loan Processing and Underwriting – Loan origination involves gathering credit histories, verifying income, assessing risk, and making lending decisions. RPA can automate data collection and entry, while AI models can analyze credit scores, predict repayment likelihood, and detect fraud. Usage of AI models results in faster loan approvals, improved credit risk assessment and enhanced fraud detection. AI-driven banking solutions in loan processing also help banks expand financial inclusion by accurately underwriting new-to-credit customers.

- Fraud Detection and Risk Management – Banks face constant threats from fraudsters attempting unauthorized transactions, identity theft, and cyber-attacks. AI algorithms monitor transaction patterns in real time to identify suspicious patterns and help block accounts or generate alerts instantly.

- Accounts Payable and Reconciliation – Manual invoice processing and financial reconciliation are error-prone and time-consuming. RPA can extract invoice data, match it with purchase orders, and post entries to accounting systems. AI adds value by detecting anomalies, duplicates, and suggesting corrections. Other additional benefits include – 70-80% reduction in processing time, improved vendor satisfaction and lower operational costs. When integrated with ERP systems, these banking automation tools provide end-to-end visibility and efficiency.

- Customer Service Chatbots and Virtual Assistants – AI-powered chatbots can handle high volumes of customer queries – balance inquiries, transaction status, card activation – 24/7, reducing the load on call centers. RPA can fetch data from internal systems to support real-time responses. Key benefits include –

- Faster resolution time

- Round-the-clock support

- Higher customer satisfaction

This is among the most visible AI-driven banking solutions improving customer engagement.

- Regulatory Compliance and Reporting – Staying compliant with financial regulations requires detailed record-keeping and timely reporting. RPA can automate the extraction and compilation of data, while AI ensures accuracy and flags inconsistencies. Key benefits include – reduced audit preparation time, enhanced compliance accuracy and minimized penalties and fines. By automating regulatory tasks, banks also free up human resources for more strategic initiatives.

- Market and Sentiment Analysis – Financial institutions can use AI to monitor market trends, analyze news and social media sentiment, and predict stock movements. This aids wealth managers and traders in making data-driven decisions. These advanced AI and RPA use cases in finance are shaping the future of advisory services and algorithmic trading.

Challenges in Implementing RPA in Banking

While RPA offers significant advantages, implementing it in the banking sector is not without challenges:

- Initial Investment and ROI: RPA implementation requires upfront investment, and the ROI may take time to materialize, especially in smaller banks with limited budgets.

- Integration with Legacy Systems: Many banks still rely on legacy systems that may not easily integrate with modern RPA solutions, requiring additional efforts to ensure seamless compatibility.

- Data Security and Privacy: As RPA bots handle sensitive customer information, banks must ensure robust data security and privacy measures to prevent breaches.

- Change Management and Employee Training: Introducing RPA into banking workflows necessitates a change management strategy to help employees adapt to new processes and develop the skills to work alongside bots.

The Future of RPA in Banking

Looking ahead, AI and RPA are poised to become even more strategic enablers in the financial services industry. As banks strive for greater agility and resilience, the trend of hyper automation – which combines RPA, AI, machine learning, analytics, and low-code platforms – is expected to accelerate, enabling the automation of complex, end-to-end processes. With advancements in artificial intelligence and machine learning, RPA bots are becoming smarter, allowing them to handle more complex tasks that require decision-making capabilities. Here are some anticipated trends:

- Intelligent Automation (IA): Combining RPA with AI and machine learning will enable bots to handle complex tasks, like predictive analysis and customer sentiment understanding, which are crucial in today’s digital-first world.

- Hyper automation: The trend of hyper automation, where multiple automation tools are used together to create end-to-end automation, is expected to become prominent in banking. This will enable banks to automate entire workflows, from initial customer interactions to final transaction processing.

- Enhanced Customer Experience: As RPA becomes more sophisticated, banks can leverage it to provide personalized, on-demand services, improving customer satisfaction and loyalty.

- Explainable AI (XAI): Ensuring that AI decisions, especially in risk and lending, are transparent and auditable.

- Intelligent Document Processing (IDP): Using AI to understand and extract data from unstructured documents like loan forms and contracts.

- Cloud-based automation platforms: Offering agility, scalability, and easier integration with modern banking systems.

Banks that embrace these AI-driven banking solutions and modern banking automation tools will not only enhance operational agility but also future-proof their organizations.

The synergy of RPA and AI is revolutionizing the financial services landscape. Right from fraud detection to loan processing and compliance to customer service, the use cases of AI in the financial services industry are diverse and impactful. With intelligent automation, banks are better equipped to drive efficiency, innovation, and customer-centricity in a competitive market. Implementing RPA in banking requires a thorough assessment, identifying suitable processes, developing a detailed implementation plan, testing and training, and ongoing support. It brings benefits such as improved efficiency, cost savings, and better customer experience. By strategically investing in banking automation tools, financial institutions can unlock the full potential of digital transformation and deliver smarter, faster, and safer services in the years to come.

Ready to streamline your banking operations?

Discover how AI and RPA use cases in finance can drive efficiency and innovation.