Banks today operate in an environment where speed, accuracy, and regulatory compliance are just as important as customer trust. While front-end digital experiences get most of the attention, the real backbone of every financial institution lies in its behind-the-scenes operations—data processing, account management, reporting, and compliance support. Back office outsourcing solutions for banking sector has become even more important as transaction volumes grow and regulations become more complex,

By leveraging specialized back office outsourcing solutions that leverage automation and AI, banks can streamline routine operations, reduce operational costs, and maintain high levels of accuracy, all while allowing internal teams to focus on customer-centric and revenue-driving activities.

This post explores how back office outsourcing improves banking efficiency.

The Growing Impact of Back Office Outsourcing in the Banking

Banking, financial services, and insurance organizations that outsource back-office operations benefit in several ways, including:

- Saving staff time for core business activities

- Improved service quality and higher customer satisfaction

- Enhanced profitability and stronger bottom-line performance

- Access to advanced, high-end technology

- Efficient management of large volumes of data with skilled resources

- Reduced risk of compliance and regulatory violations

- Streamlined handling of transactional processes

As banking services rapidly digitize, more than 70% of financial institutions are turning to financial back office outsourcing to achieve scalability, flexibility, and consistent regulatory compliance across global markets.

According to Verified Market Reports, the banking back office outsourcing market is valued at approximately USD 25 billion in 2024 and is projected to grow to USD 45 billion by 2033, expanding at a CAGR of 7.5% between 2026 and 2033. This growth is largely driven by the increasing adoption of automation technologies such as robotic process automation (RPA) and AI-driven analytics.

These technologies are transforming routine back-office functions, including compliance checks, fraud detection, loan processing, and reconciliation, that once consumed nearly 40% of operational resources. By reducing manual intervention and improving decision-making accuracy, AI-driven outsourcing solutions have helped leading banks cut operational costs by almost 25%.

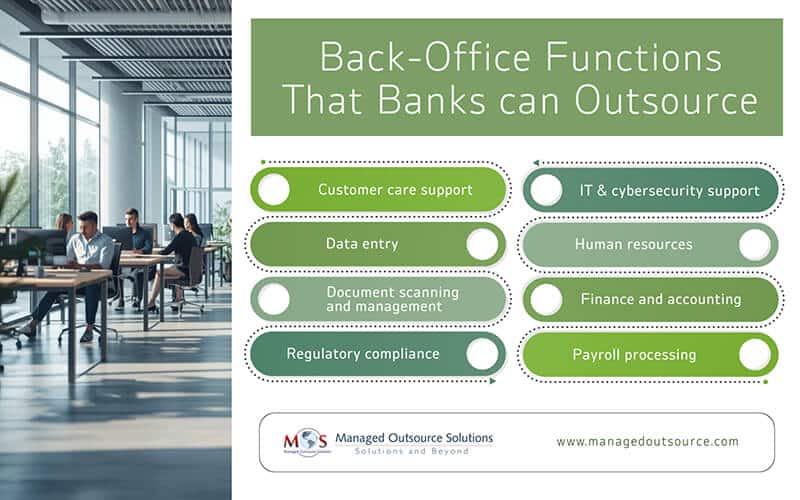

Different Back Office Functions That Can Be Outsourced

Back office processes that are worth outsourcing for the finance and banking sectors are

- Customer Support

Satisfied customers play a key role in business growth. Professional BPO companies can provide banks with the services of skilled and well-trained customer support professionals. With in-depth knowledge of banking services, strong typing skills, and the ability to handle telephonic interactions effectively, customer support professionals can deliver high-quality pre- and post-sale customer experiences.

- Data Entry

Banking involves a lot of online and offline data entry such as filling up paper forms, dealing with bills and coupons, online databases, extracting and compiling the data from images and scanned documents, and so on. Outsourcing this time-consuming task can provide employees with more time to focus on critical, high-value functions. Experienced data entry companies can extract data from questionnaires, surveys, images, forms, and other sources, making information easy to access, organize, and use.

- Document Scanning and Management

Accessing information from large volumes of paper documents can be time-consuming and labor-intensive. Document scanning solutions allow data to be stored digitally, either on local drives or in the cloud, making it easily accessible and streamlining operations. Professional service providers can assist in scanning and indexing all types of financial documents, including trading reports, annual reports, merger and acquisition papers, and more. By leveraging digital storage, banks can also reduce operational costs and save valuable office space.

- Regulatory Compliance

Banking and financial institutions must be up to date with the laws, regulations, and standards that are relevant to their business processes. Violating regulatory compliances or failing to comply with regulations can lead to fines and penalties by government agencies. Regulatory compliance risk management services help banks to meet all regulatory requirements and ensure seamless operations. This is a crucial aspect of banking operations management.

- IT & Cybersecurity Support

With cyberattacks, hacks, and data breaches becoming increasingly common, securing all banking transactions is critical to protecting customer assets. Outsourcing IT and cybersecurity tasks to a trusted service provider ensures robust protection against security threats, minimizes risks, and helps banks maintain the integrity and confidentiality of sensitive data.

- Human Resources

Outsourcing Human Resources functions ensures that employee-related matters are effectively managed and aligned with organizational goals. HR professionals maintain smooth operations by managing employee relations, implementing policies, and optimizing workflows across the organization.

- Finance and Accounting

Managing a company’s financial health requires accurate bookkeeping, efficient handling of accounts payable and receivable, and meticulous maintenance of the general ledger. Outsourcing these functions to a trusted third-party vendor ensures precise financial reporting, providing a clear view of capital flows and overall organizational performance.

- Payroll Processing

Efficient payroll management is key for timely and accurate processing of salaries, benefits administration, and onboarding documentation. Outsourcing this function ensures that employees are compensated correctly and efficiently, supporting organizational productivity and operational stability.

Growing Role of AI in Back Office Efficiency

Back office workflow automation and AI adoption in banking is growing rapidly, with most use cases focused on improving efficiency and customer experience. About 55% of AI applications are currently used in front-office functions such as retail banking, commercial banking, and wealth management. The remaining adoption is spread across middle- and back-office operations, where AI supports automation and process optimization.

Key AI use cases in the banking sector include:

Chatbots and AI-powered customer support to handle customer queries quickly and accurately

- Real-time foreign exchange insights to support faster and better trading decisions

- AI-assisted advisory platforms that help relationship managers offer personalized financial guidance

- AI-driven software development and testing tools to improve system reliability and reduce downtime

- Automated loan processing and credit risk assessment for faster approvals and improved risk management

Rather than replacing human roles, AI-assisted back office outsourcing solutions for the banking sector are reshaping how banking professionals work. By automating repetitive and time-consuming tasks, AI allows employees to focus on strategic planning, relationship management, and decision-making. This shift helps banks optimize resources, improve productivity, and invest in developing high-value talent across the organization.

Back office outsourcing offers financial institutions a strategic advantage by streamlining essential operations, reducing costs, and ensuring high levels of accuracy across data processing, regulatory compliance, and customer support functions. By partnering with specialized outsourcing providers, banks can focus their internal teams on innovation, customer engagement, and revenue-generating activities, while confidently relying on experts to handle complex back-end processes.

Streamline your banking operations today

Explore back office outsourcing solutions

Contact Us