The major part of government revenue is from the taxes which they collect from different sources from the public based on tax laws. However, tax laws may undergo changes every year. Taxpayers should therefore keep themselves updated with the latest tax laws in order to file error-free tax returns and avoid penalties. However, there are some common mistakes such as delaying returns and audit prompting. The best way to reduce errors is to transfer important files into an electronic device. Another option is to take advantage of business process outsourcing companies.

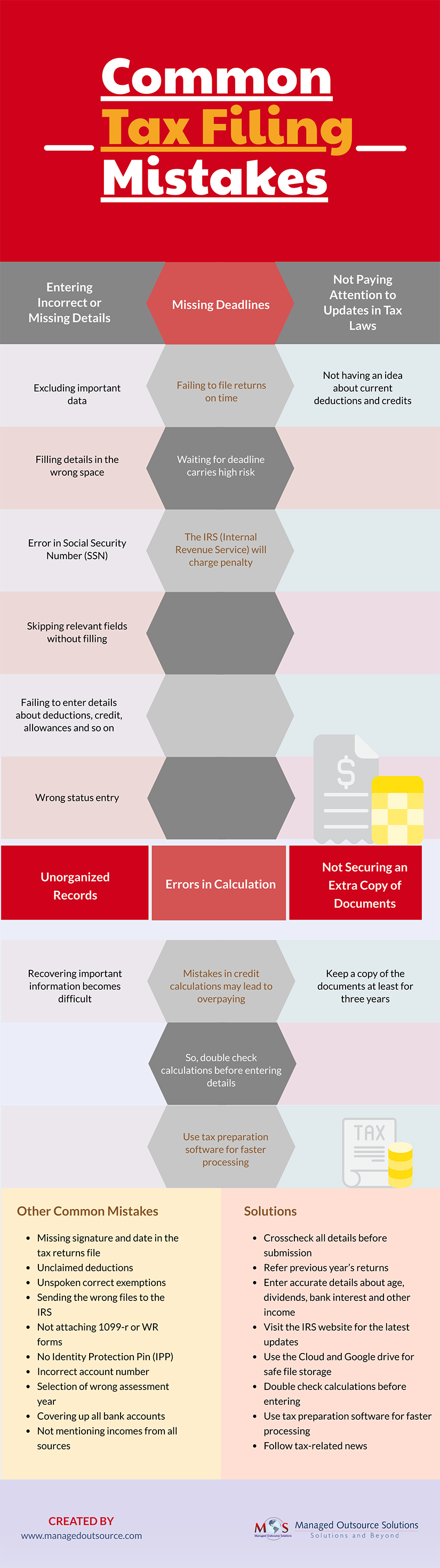

At the same time, there are errors that everyone should consider. The infographic given below can make you aware of possible tax filing mistakes you can make.