Banks face constant pressure from customers demanding quick service, fierce competition, and changing regulations. The introduction of Robotic Process Automation (RPA) in the banking industry has changed their daily operational activities quite significantly. RPA applies cutting-edge software tools to automate the routine chores that have been manually done by humans for years. The intention is not to replace employees but to enable them to focus on the more significant aspect of the business.

RPA in the banking sector is bringing about results that can be quantified: reductions in costs, quicker processing, and customer satisfaction. Many leading banks have already deployed hundreds of bots across their operations, gaining a competitive edge. Regional and community banks are now implementing RPA too, starting small and scaling up as they see benefits.

Ready to automate your banking operations with Robotic Process Automation (RPA)?

What is Robotic Process Automation (RPA) in the Banking Industry?

The banking industry uses RPA, powered by software bots and automation technology, to handle time-consuming, repetitive business tasks automatically. A “bot” can be compared to a virtual worker who will strictly adhere to a given set of rules and procedures. The bot will work continuously, 24/7 without fatigue or error. These bots can:

- Fill out forms and collect data

- Copy data between systems

- Read and process documents

- Send emails and alerts

- Process payments

- Check information against rules

RPA does not require you to change your existing banking systems. It works on your current software, just like a human employee would.

The RPA Market in Banking

RPA is gaining rapid traction in the banking industry. Rather than being a trend, it represents an underlying change in the way banking is conducted.

Key market facts:

- The global RPA in banking market is worth $1268.15 million in 2025

- It is expected to grow to $14447.74 by 2034

- That represents a growth rate of 16.7% annually

- Banking holds more than 59% of the total RPA market in financial services

Banks that implement Robotic Process Automation Services see lower costs, faster processing, and improved customer satisfaction. Leading institutions like JPMorgan Chase and Deutsche Bank are already deploying hundreds of bots. Smaller banks are discovering RPA makes them competitive without breaking their budget.

Top Benefits of RPA in Banking

- Faster Processing

RPA speeds up critical banking processes dramatically:

- Mortgage loans: Processing time is reduced from 50-53 days to minutes

- Loan applications: Approval time cut from weeks to hours

- Account opening: Set up completed in minutes instead of days

- KYC verification: Customer checks completed in hours with zero errors

- Card applications: Credit card approval now takes hours instead of weeks

The advantage of speed has a direct correlation with customer satisfaction and loyalty. When clients secure a loan in just 2 hours rather than 2 weeks, customer satisfaction is substantially enhanced.

- Lower Costs

Manual work increases operational expenses significantly. When RPA takes over repetitive tasks, costs drop significantly.

RPA cuts costs by:

- Reducing the need for large data entry teams

- Cutting overtime and errors that need fixing

- Saving money on compliance work

- Decreasing operational expenses by automating back-office processes

- Lowering the cost of employee training

Real example: Banks spend over $384 million per year on KYC checks. RPA can cut this cost dramatically. A bot that costs $50,000 per year to run can save a bank $300,000 per year in labor costs. Many banks see a return on their Robotic Process Automation Services investment within just 6-12 months.

- Better Accuracy

Unlike human workers, bots eliminate operational errors. RPA achieves this by:

- Data entry and transfers happen perfectly every single time

- Compliance rules are followed exactly

- Wrong information is prevented from being processed

- Rework and corrections are reduced

- Error rates drop from 5-10% to less than 0.5%

Better accuracy also means better compliance. When data accuracy is consistently maintained, regulatory satisfaction is ensured. Complete, immutable audit trails are automatically generated.

- Round-the-Clock Service

Banks employing RPA benefit from continuous operational capability:

- Artificial intelligence Chatbots answer questions from customers 24/7.

- Bots process transactions at night and on weekends

- Operational continuity without staff availability constraints

- Customers obtain immediate assistance at any point in time

This 24/7 service is becoming essential in banking. If you do not offer it, customers will go to a bank that does.

- Stronger Compliance

Banking is heavily regulated. RPA helps you stay compliant:

- Automatically checks customer data against regulations

- Creates perfect audit trails showing what happened and when

- Updates compliance rules automatically when laws change

- Reduces the risk of expensive regulatory fines

- Ensures every process follows the exact same steps every time

With manual processes, different employees might handle compliance differently. With RPA, compliance is consistent every single time.

- Better Customer Experience

Faster service delivery results in enhanced customer satisfaction:

- Quick loan approvals increase satisfaction

- Reduced error rates result in decreased customer frustration

- 24/7 Chatbots support addresses customer issues in real-time

- Reduced wait times for account setup and service requests

- Smoother, hassle-free banking

Customers who complete account opening processes within a single day through RPA-enabled systems exhibit substantially higher satisfaction levels.

- Higher Productivity

Your team operates more efficiently with greater strategic focus:

- Bots handle boring, repetitive work

- Staff focus on complex, valuable tasks

- Fewer interruptions and manual handoffs

- Operations run smoother with less confusion

- Employees find more satisfaction in their work

When RPA handles the tedious work, your employees can focus on more important business tasks. They can engage with clients, resolve issues, and participate in the financial planning of the future.

Real-World RPA Use Cases in Banking

Loan Processing and Credit Decisions

Bots extract applicant information from documents automatically. They check credit scores and verify employment. They make approval decisions based on your rules. What took weeks now happens in just hours.

Customer Onboarding (KYC Process)

RPA manages the complete account opening procedure, from collecting documents to verifying customer identity, running compliance checks and finally, opening the account. Account setup that took days now takes minutes.

Payment Processing

Bots verify account numbers and payment details, then automatically transfer the funds, confirm payments with all parties, monitor for suspicious activities, and process thousands of transactions daily. Consequently, processing payments becomes expedited, more secure, and highly accurate.

Accounts Payable (Invoices)

RPA automatically processes vendor invoices by extracting data, validating against organizational records, and authorizing payment upon verification. Automated processing reduces vendor invoice turnaround from multiple days to mere hours.

Fraud Detection

Bots monitor transactions in real-time, flag suspicious patterns immediately, alert security teams to unusual activity, protect customer accounts faster, and work with AI to learn from fraud patterns. Fraudulent transactions are caught before damage occurs.

Mortgage Processing

RPA collects and verifies all required documents, checks credit scores and employment, runs property inspections automatically, and coordinates between departments. Processing time is reduced dramatically.

Report Generation and Regulatory Compliance

Bots gather data from multiple banking systems, validate all information, create properly formatted reports, submit reports on time, and maintain complete audit trails. Compliant, accurate reports are generated automatically.

Customer Service Improvement

AI Chatbots function round the clock to provide replies to questions. The automated systems are able to check customer’s account balances, reset passwords, issue new credit lines and even solve common problems without any human intervention. While customers obtain immediate assistance, staff members allocate their time to address complex issues.

Account Closure Process

RPA sends automated reminders for required documents, verifies all closure requirements are met, processes closures according to your rules, generates confirmation documents, and updates all systems. Safe, quick, error-free account closures.

How Robotic Process Automation Company Can Help

Working with a Robotic Process Automation Company gives you significant advantages:

Expert Guidance: They know which processes are suitable for automation to give the best ROI.

Accelerated Implementation: Their extensive experience facilitates rapid RPA implementation in reduced turnaround time and earlier access to the benefits, while avoiding costly mistakes.

Proper Training: Your staff acquires the skill to work with the automation in a productive manner. They become familiar with the monitoring of the bots, handling exceptions, and improving work flow.

Ongoing Support: They can help when you need to make modifications or want enhancements. In case any new process needs to be automated, they can offer service support and feedback.

Best Practices: They bring industry knowledge from other banks. They offer practical solutions and know what works in different scenarios.

Risk Management: They ensure that your RPA implementation is protected with the right security, compliance, and audit controls.

Choosing the right Robotic Process Automation Company can mean the difference between success and failure.

Challenges and Solutions

Legacy System Integration: Many banks still rely on legacy systems that do not integrate with each other. The solution lies in opting for new systems that are easier to automate and reduce dependency on outdated technology.

Managing Employee Concerns: Employees commonly express concerns regarding automation’s potential impact on employment. Organizations must emphasize that RPA implementation reduces administrative burden, facilitates professional development and enables career advancement opportunities.

Choosing the Right Processes: RPA does not offer a complete solution for all banking processes. The automation is best suited to handle task based repetitive work with high volume.

Ensuring Compliance and Security: When bots manage private financial information, security automatically becomes a core issue. Therefore, it is crucial to have security included in the design right from the beginning. Encryption of data must be made mandatory to meet the requirements set by the banking sector.

Key Statistics

- Reduction in manual work: Up to 70% of repetitive tasks eliminated

- Reduced error rates: Near 100% data accuracy

- Cost savings: 20-35% reduction in operational expenses

- Processing speed: Days of work completed in hours

- Customer satisfaction: Improved due to faster service

- ROI: Many banks see returns within 6-12 months

- Operational efficiency: 80%+ improvement in processing time

Return on Investment (ROI)

Year 1: Bot implementation costs approximately $50,000. However, it eliminates work that cost $300,000 in labor. Your net savings are $250,000.

Year 2 and beyond: The bot continues delivering $300,000 in labor savings. Year 2 profit is $290,000+.

Over 5 years, one bot can save your bank over $1 million. Most banks calculate an ROI of 15-25% in the first year. This represents superior returns compared to most alternative investments.

Future of RPA in Banking

- AI Integration: RPA combined with artificial intelligence facilitates informed decision making, not merely expedited processing.

- Blockchain Support: RPA will automate blockchain transactions and smart contracts.

- Voice and Gesture Control: Future bots will understand spoken commands and hand gestures.

- Real-Time Compliance: Regulations will be enforced automatically as they change.

- Predictive Analytics: Bots will predict problems before they happen.

- Hyper-Personalization: Customers will experience fully customized service delivery automatically.

Important Reminder

RPA adoption does not represent the end of banking careers. When bots handle routine work, your team:

- Focuses on complex customer issues

- Makes higher-value business decisions

- Builds better customer relationships

- Innovates new services

- Moves into management and strategy roles

In fact, banks that implement RPA successfully often find they need more employees, not fewer. The bots free up capacity for growth.

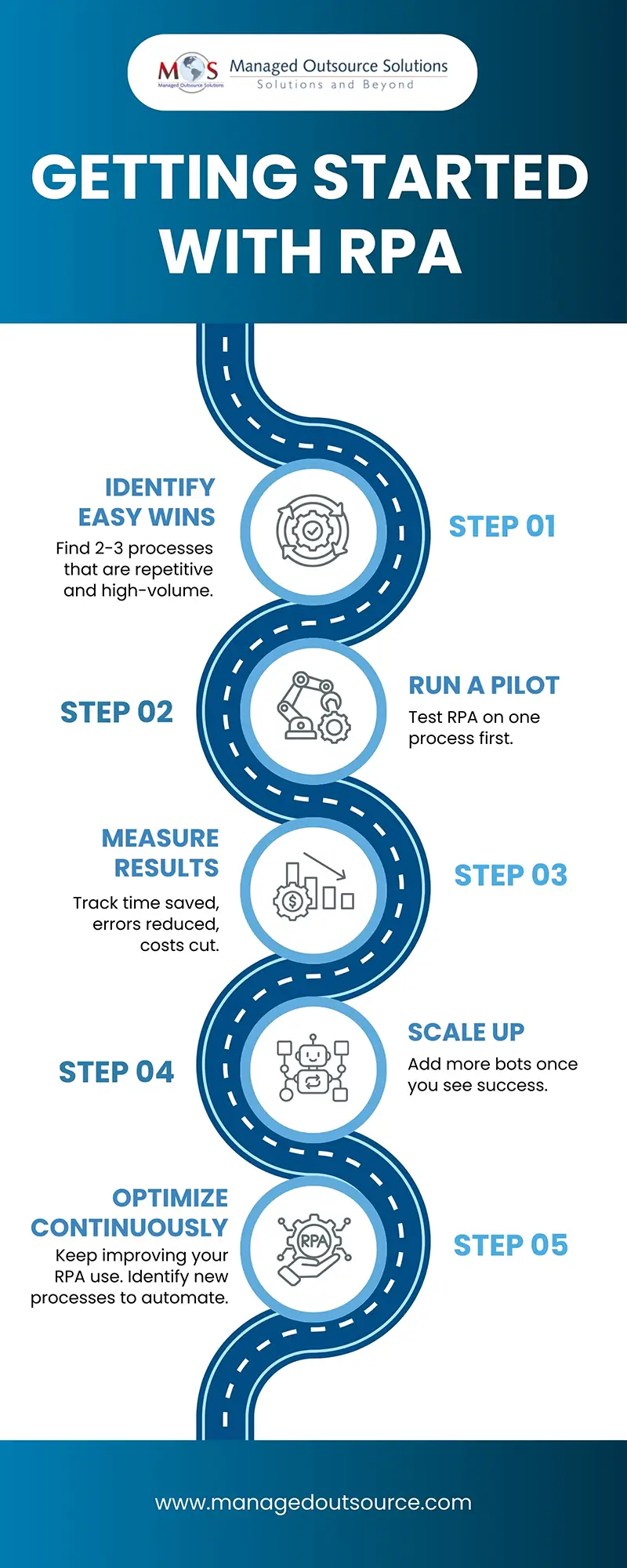

Getting Started with RPA

Organizations should initiate implementation on a limited scale. Do not attempt to automate all processes simultaneously:

Many leading banks started with just a few bots and quickly expanded. Your bank can do the same.

Why Banks Need RPA Today

The future of banking is fundamentally automated. Manual processes simply are insufficient to meet contemporary operational demands. Banks that implement RPA gain the following advantages:

- Speed: Faster service than competitors

- Cost reduction: Lower operational costs

- Quality: Better accuracy and compliance

- Employee efficiency: Improved staff engagement and operational efficiency

- Customer satisfaction: Better service experience

To stay competitive and efficient, banks are turning to RPA services automate repetitive processes and boost productivity. By working with an experienced Robotic Process Automation Company, banks can reduce reliance on manual processes, reduce costs, and modernize core operations.

Don’t let manual workflows slow your bank down.

Partner with our Robotic Process Automation Services team today

Contact us